This Giving Toolkit is designed to help you understand how to make a gift in your Will to MS Plus. A gift in Will can often be called a bequest or a legacy and even a devise, depending on the type of item given. You can find out more below or please contact us on 1800 443 867

How can we help you?

Many know that a Will is an important document that means your final wishes will be fulfilled in the exact ways you ask. A Will can also be a great way to reflect your values, beliefs and have your final say on what matters to you most. It will make sure your loved ones are cared for and your legacy can live on.

Our essential information on how to fast-track a cure by leaving a gift for MS in your Will can be found in our Friendly guide to writing your Will.opens in new tab

Partner with us

Legal name: MS Plus Ltd, a charitable organisation

ABN number: 66 004 942 287

Suggested wording for your Will

We cannot provide you with specific legal advice. However, here are some examples of wording you may consider with your legal advisor when you are preparing or updating your Will to include MS Plus if you wish.

Information for solicitors and executors

If you are an executor and have a gift to pass on to help those living with MS, please reach out.

Our supporter stories

We will remember our supporters and celebrate their stories and the impact they have on the MS community. By celebrating their generosity and kindness, we will remember their legacy.

Write a free Will with Gathered Here

Gathered Here offers our supporters free legally binding Wills and updates for life. Making a Will with Gathered Here is easy and can be done in less than 10 minutes, all from the comfort of your own home.

Keep in touch

We want to thank you for your generosity with regular updates about how your contribution is making a real difference to people living with MS, and their loved ones.

Join our MS Callistemon League

If you choose to include a gift in your Will to MS Plus, you are invited to become a member of the MS Callistemon League. You’ll be recognised and thanked for your heart-warming generosity and for your lasting impact on the lives of people who have MS.

Leaving a gift in your Will

We recommend that you speak with your financial advisor, solicitor or estate planner to ensure that your wishes are properly expressed, and best suit your circumstances.

Your solicitor will have their own way of including your wishes to best suit your estate and wishes. We suggest taking to your solicitor our full legal name, ABN and address details plus your wish for the best style of gift and amount.

We will concentrate on doing the best we can – helping fund vital research and providing the best services to people living with MS, to ensure that we can fast-track a cure and care until we're there!

Legal name: MS Plus Ltd

ABN number: 66 004 942 287

Registered address: 54 Railway Road, Blackburn VIC 3030

Why do I need a Will?

Hear from a solicitor: in this video series find out the important steps to making your wishes known

How to leave a gift in your Will

You don’t need to be wealthy to leave a gift in your Will, any amount is appreciated and will be used to help provide services and support for those living with MS, as well as providing vital funding for research, better treatments and earlier detection.

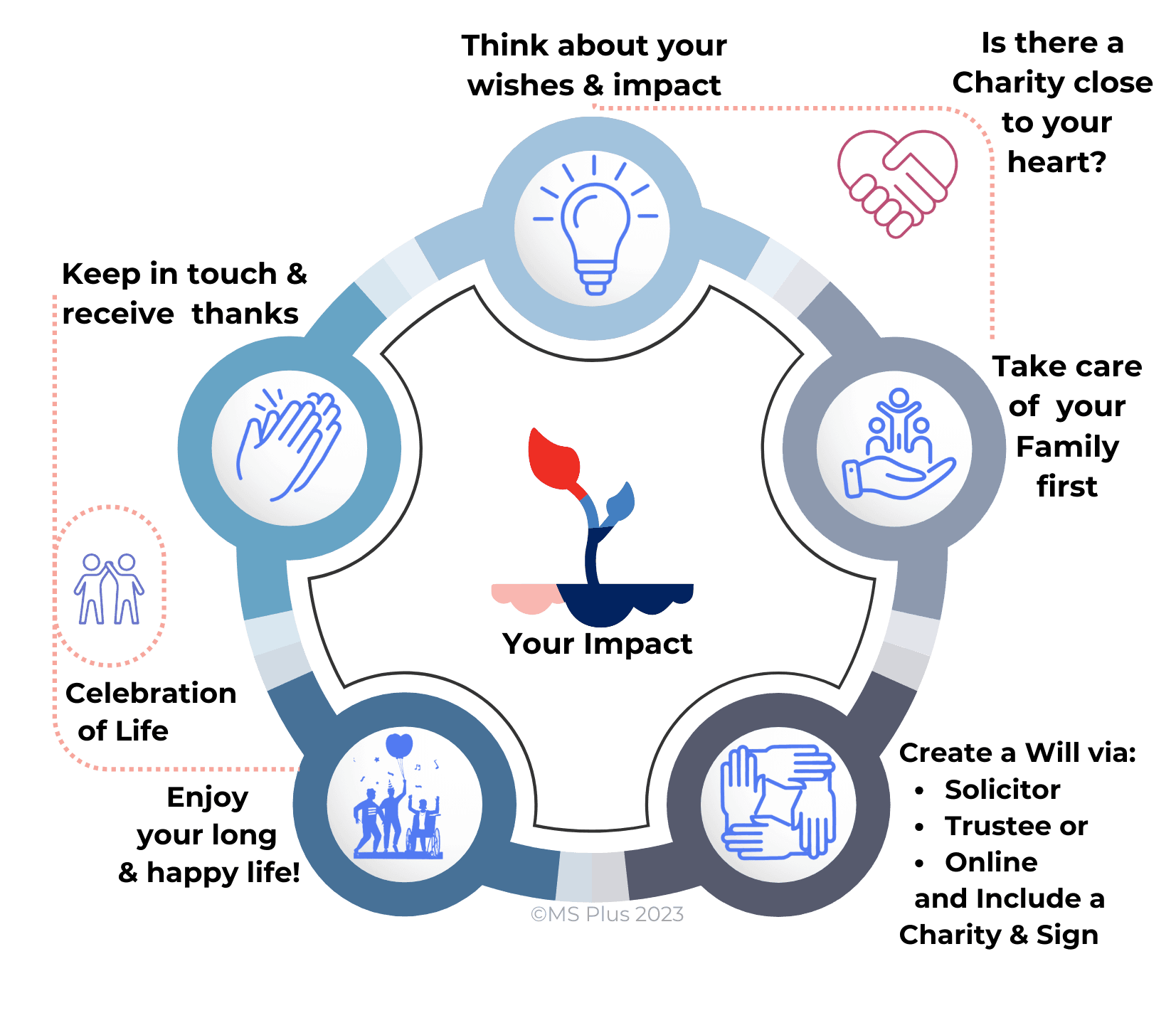

Here are our top tips to think about how to leave a gift in your Will:

Types of gifts you can leave in your Will

Sample beneficiary nomination

Under the current superannuation laws in Australia, funds cannot pass directly from a superannuation fund to a charity. However, superannuation reforms are being discussed in the industry.

In the meantime, if you specifically direct in your Will that your Superannuation (Trust) fund 'forms part of your estate' that then means that your executor has the right to distribute and nominate the use of the super funds as directed, including distributions to a charity, if those wishes were known.

Make sure you are using the following details:

Legal name: MS Plus Ltd

ABN number: 66 004 942 287

Find out more about how to leave a gift in your Will

A friendly guide

Essential information on how to fast-track a cure by leaving a gift for MS in your Will

Fast-track a cure for MS

Find out more about the impact your gift has on protecting future generations from MS.

MS Callistemon League

Meet other members of our MS Callistemon League, who are helping to improve the lives of those living with MS and to help search for a cure.